‘Help me do it’ profile investing

If you don’t want to take an active role in your investment decisions, but you don’t think you’ll be taking your Atlas pension account as cash when you retire, you might want to consider an alternative option. If you’re thinking about using your pension account to give you a regular income, then either of the following lifestyle options might better suit you than the ‘Do it for me’ option.

Have a look on the website, or at the investment guide for more detail on where your funds are invested, depending on which outcome you choose. If you’re unsure where to start, don’t forget you’ll be invested in the ‘Do it for me’ profile, until you decide to make changes.

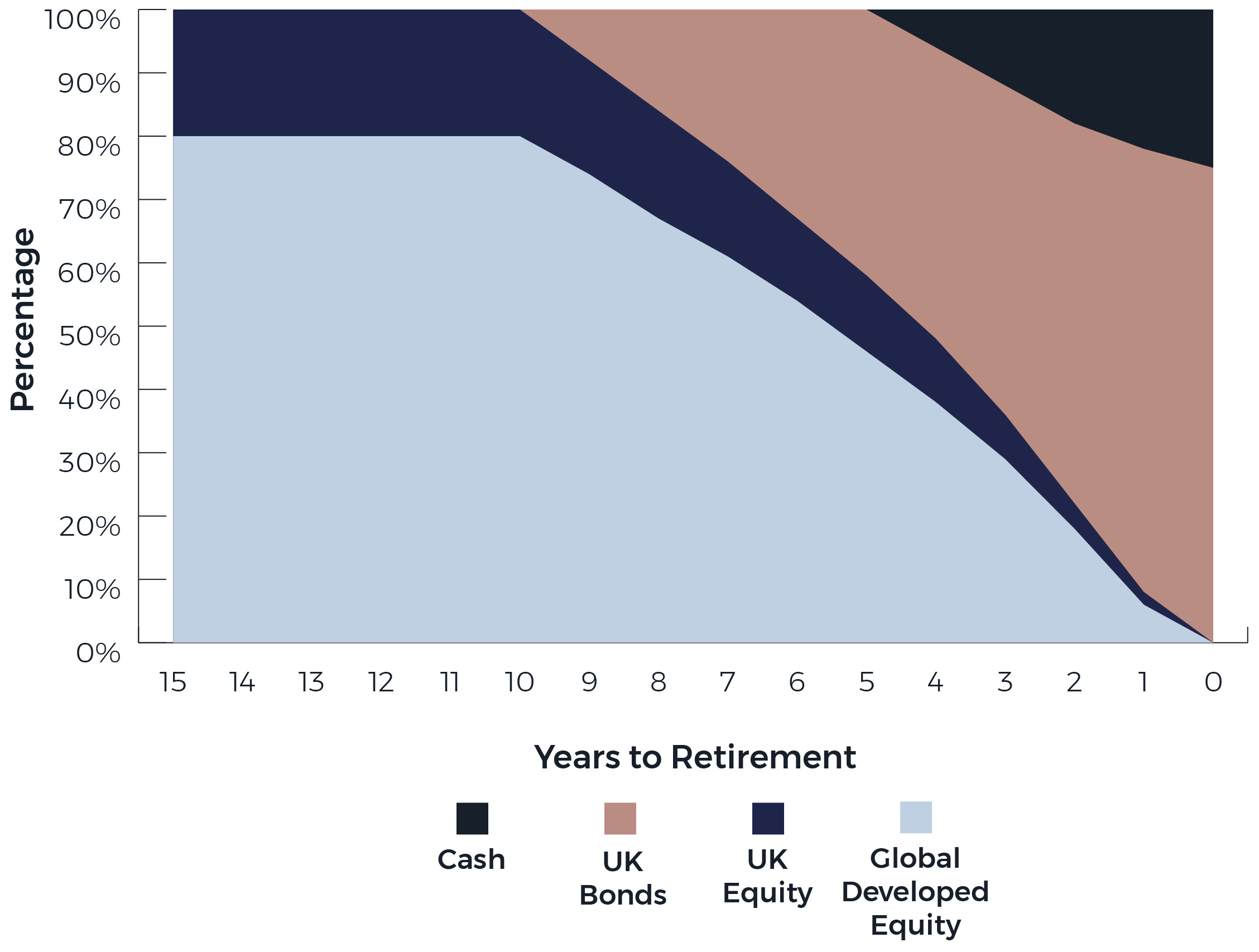

Drawdown Lifestyle Strategy

This option could be selected if you wish to draw an income directly from your retirement savings whilst leaving a proportion of it invested (known as Flexi-Access Drawdown or taking multiple Uncrystallised Fund Pension Lump Sums).

Like the Cash Lifestyle Strategy, this option switches out of more risky assets as you approach retirement (wit the objective being that any falls in investment markets, which you would struggle to make up in the short period to retirement, should have less of an impact on your fund). However, in the immediate years to retirement, the fund remains invested in a combination of growth-seeking assets, bonds and cash. Hence, at retirement, this option is still exposed to investment markets with the aim of generating modest levels of growth to limit any income withdrawals eroding the value of your retirement savings too quickly.

A type of loan to a government or company that is repaid with interest

Further information on Drawdown is available within the Retirement Guide.

This investment option may not be suitable for you if you do not plan to leave your savings invested in retirement to draw an income.

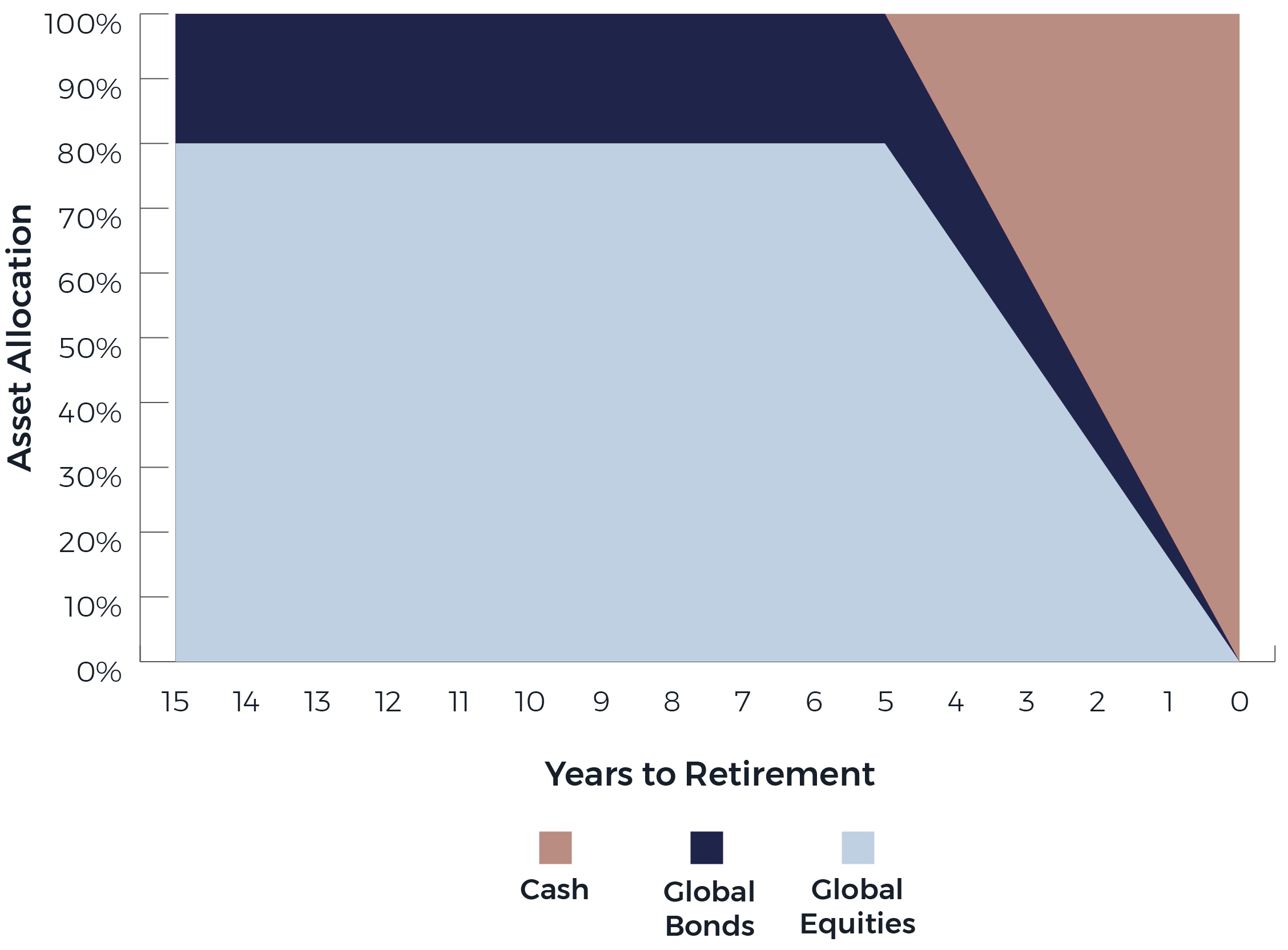

Annuity Lifestyle Strategy

Alternatively, you could choose this option if you wish to buy an annuity at retirement.

A regular income paid by an insurance company

This option switches out of more risky assets to bonds and cash as you approach retirement (with the objective being that any falls in investment markets, which you would then struggle to make up in the short period to retirement, should have less of an impact on your fund). In the immediate years to retirement, this option will be invested in bonds and cash. The bonds that this option switches to are expected to move more closely in line with changes in annuity prices, to provide more certainty of the amount of income you can get by buying an annuity.

This investment option may not be suitable for you if you do not plan to buy an annuity at retirement.

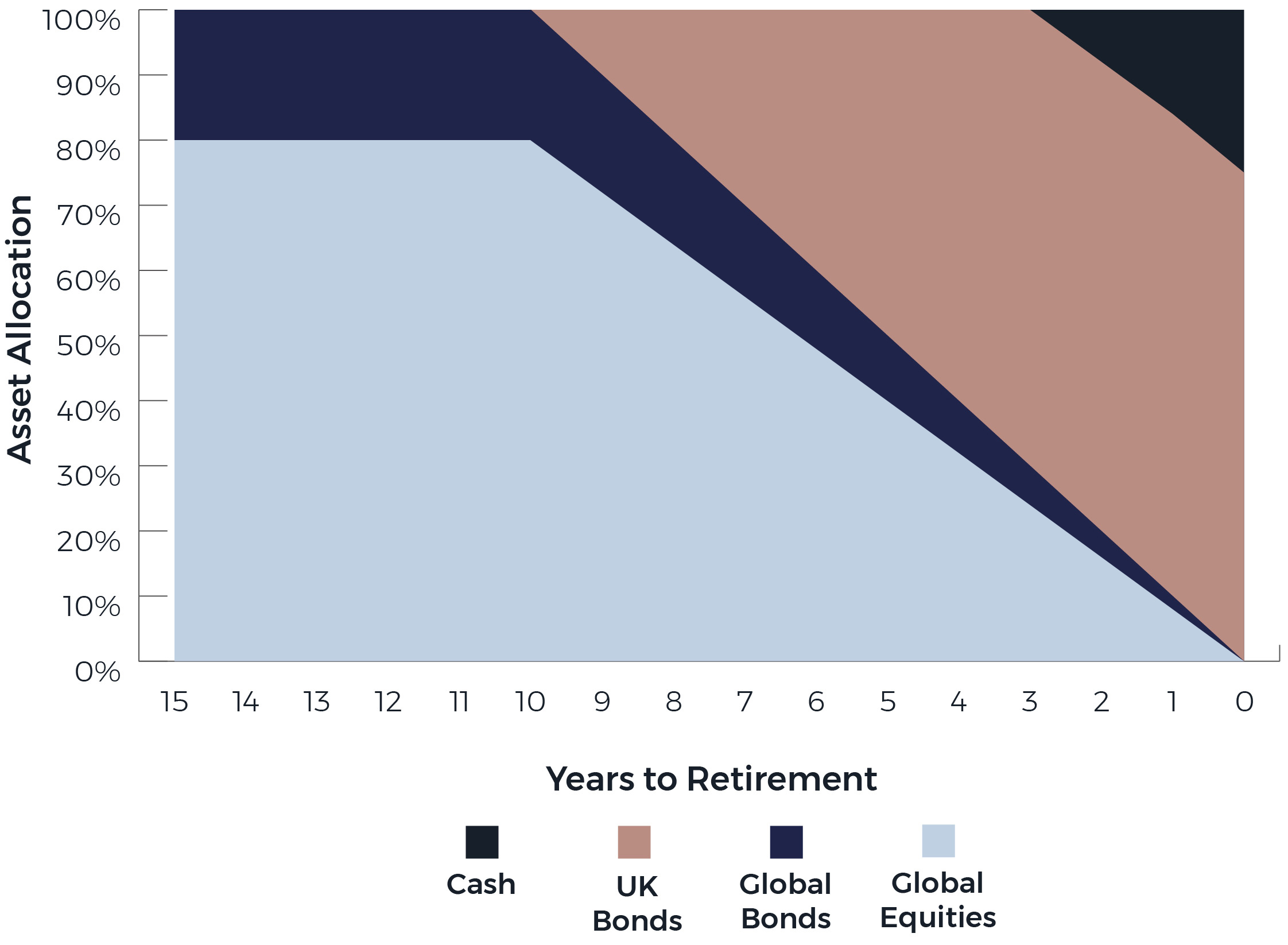

Passive Global Equity Lifestyle Strategy

This option is available to you if you’re already in this strategy.

This lifestyle strategy targets the purchase of an annuity at retirement, but unlike the Annuity Lifestyle Strategy is fully invested in equities in the years further from retirement, split across the UK (20%), and overseas (80%). passive management is used throughout, and currency hedging is used for the developed overseas equities elements (but not emerging markets) to reduce volatility associated with fluctuations in exchange rates. This fund also incorporates a 5% cap on the amount which can be invested in any single stock within UK equities.

Shares in a company

Investments that are largely managed by tracking a particular index, e.g. by investing in all the funds in the FTSE100

Making certain types of investments to protect funds from changes in exchange rates

Shares in non-UK companies in economically developed countries, such as those in Europe, the US or Japan

Investments in countries that are considered be less economically developed, such as in South America, India or China

This option switches out of equities and into bonds and cash as you approach retirement (with the objective being that any falls in investment markets, which you would then struggle to make up in the short period to retirement, should have less of an impact on your fund). In the immediate years to retirement, this option will be invested in bonds and cash. The bonds that this option switches to are expected to move more closely in line with changes in annuity prices, to provide more certainty of the amount of income you can get by buying an annuity.

This investment option may not be suitable for you if you do not plan to buy an annuity at retirement.